Medical Benefits

Welcome

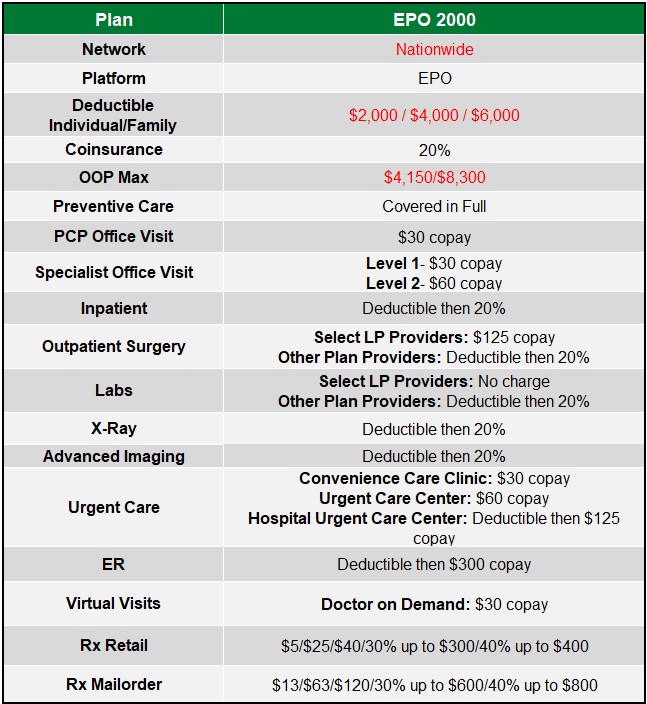

Littleton Food Co-op’s health insurance plan is administered by HPI. Littleton Food Co-op offers one plan, the EPO 2000.

Eligibility

All regular full-time employees working 30+ hours a week are eligible to enroll in health insurance. Eligibility for newly hired employees is first of the month, following 60 days of employment (within 90 days).

Benefit Information

How do I enroll?

All employees will submit their benefit elections through Employee Navigator. Newly hired, regular employees who work at least 30 hours per week, will enroll for health insurance benefits during the new employee orientation period. Eligibility begins on the first of the month, following 60 days of employment (within 90 days).

Open Enrollment is your opportunity to make new benefit elections or changes to your current benefit elections.

If you miss the new hire or open enrollment window, you will have to wait until the next open enrollment to enroll in benefits unless you experience a qualifying life event.

Waiving or Declining Health Insurance

If you are eligible for health insurance and will not be enrolling because of alternative coverage, or choose not to have insurance, a waiver form must be signed during the enrollment period. If you elect not to enroll, you may not join the plan until the next Open Enrollment period, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections, outside of the normal, Open Enrollment period. Examples of Qualifying Life Events include: the birth of a child, marriage, divorce and a loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining Littleton Food Co-op’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave Littleton Food Co-op?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

Health Plans Inc (HPI): Medical Insurance

Customer Service: 800-532-7575

Website: HPI | Self-Funded Health Plans

Contributions & Rates

Note: Employee pays $20 per week for Employee Only coverage. For all other coverage levels, the employee pays $20, plus 75% of the additional premium.

Plan Summaries

Summaries of Benefit Coverage

Additional Resources

Flexible Spending Account (FSA) & Dependent Care Account (DCA)

Flexible Spending Account (FSA)

Medical FSA Basics

Medical FSAs are used to set aside money for planned or reoccurring qualified medical expenses that are not covered by insurance, such as dental care, vision care, contact lenses, co-pays, deductibles, out-of-network expenses. For a list of qualified expenses visit: https://www.irs.gov/pub/irs-pdf/p502.pdf

- You can open a medical FSA and contribute up to $3,300 each year to cover qualified out-of-pockets costs.

- You have full access to your total election amount on the 1st day of the plan year. You do not need to wait until your FSA payroll deductions equal the amount of your qualified medical expense.

- Most transactions can be paid at the point of sale with a debit card pre-loaded with your total FSA amount for that plan year.

- You may carryover up to $660 into the next plan year. Any remaining funds exceeding $660, would be forfeited.

Dependent Care FSA (DCA) Basics

A DCA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, or other care for qualified tax dependents. To qualify for a dependent care FSA, the IRS requires that the dependent care is necessary for you or your spouse to work, look for work or attend school full-time.

In 2025 the maximum amount you may contribute to the dependent care FSA is $5,000* (if single or married & filing jointly) or $2,500* (if married & filing separately) Please note that the DCA is 100% employee funded and is only available to use as monetary contributions are made.

Carrier Contact Information

Health Plans Inc. (HPI): Flexible Spending Account (FSA) & Dependent Care Account (DCA)

Customer Service: 877-734-7004

Website: www.hpitpa.com

email: flex@healthplansinc.com

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Dental Benefits

Eligiblity

All employees who work a minimum of 20 hours per week are eligible, first of the month, following 60 days of employment (within 90 days).

Summary of Benefits and Coverages

Plan Overview

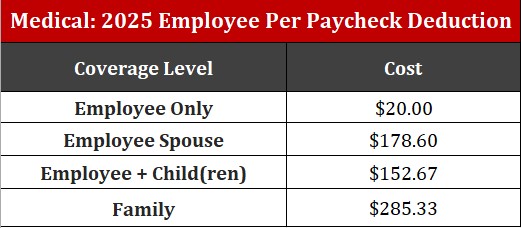

Littleton Food Co-Op offers it’s employees one dental plan through Anthem.

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by Littleton Food Co-op.

Network – To locate an in-network dentist, please visit www.anthem.com/provider/dental or call the toll-free number on the back of your Anthem ID card.

Cost to Use – There is no deductible for Preventive Services or Diagnostic Services. All other covered services will be subject to the Individual deductible of $50 or Family deductible of $150.

The annual maximum is $2,000 per member. The annual maximum may be increased to as much as $2,000 per person with Anthem’s Maximum Annual Carryover Feature. See the attached Certificate for more information. After meeting the deductible, you will be responsible for 20% of the cost of in-network Basic services, 50% of Major services, and 100% of all services once you’ve reached your annual max of $2,000, unless you benefited from Anthem’s Maximum Carryover Feature.

Cost to Own – What will your per paycheck deduction be? The amount that will be deducted from each paycheck is listed below.

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

How do I enroll?

All dental insurance enrollments must be completed through Employee Navigator.

Newly hired, regular employees who work at least 20 hours per week, will enroll for dental insurance benefits during the new employee orientation period. Eligibility begins on the first of the month, following the 60 days of employment (within 90 days).

Anthem Blue Cross Blue Shield: Dental Insurance

Customer Service: 800-331-1476

Website: www.anthem.com

Contributions & Rates

Plan Documents

Vision Benefits

Eligiblity

All employees who work a minimum of 20 hours per week are eligible, first of the month, following 60 days of employment (within 90 days).

Summary of Benefits and Coverages

Plan Overview

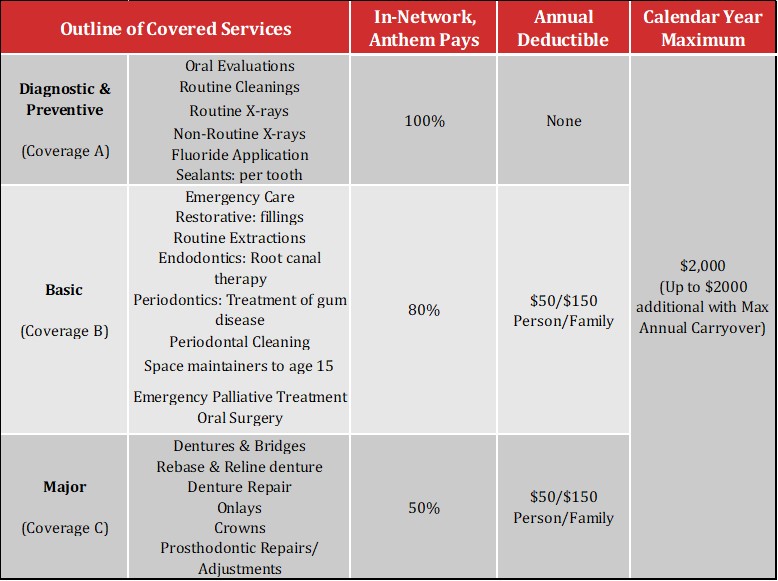

Littleton Food Co-Op offers it’s employees a voluntary vision plan through DeltaVision.

The plan provides in and out-of-network benefits as summarized in the chart below.

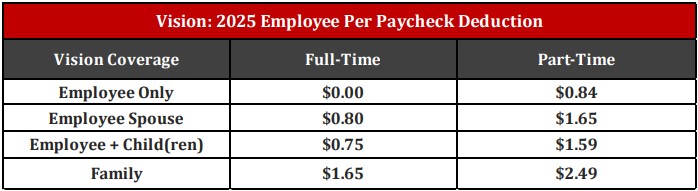

Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

How do I enroll?

All vision insurance enrollments must be completed through Employee Navigator.

Newly hired, regular employees who work at least 20 hours per week, will enroll for vision insurance benefits during the new employee orientation period. Eligibility begins on the first of the month, following the 60 days of employment (within 90 days).

Carrier Contact Information

![]()

DeltaVision: Vision Insurance

Customer Service: 866-723-0513

Website: EyeMed Vision Benefits

Plan Documents

Group Life Insurance

Eligibility

All active, regular full-time employees who work 30+ hours per week are eligible, first of the month, following 60 days of employment (within 90 days).

Employees are automatically enrolled through Anthem in Life & AD&D as they

become eligible.

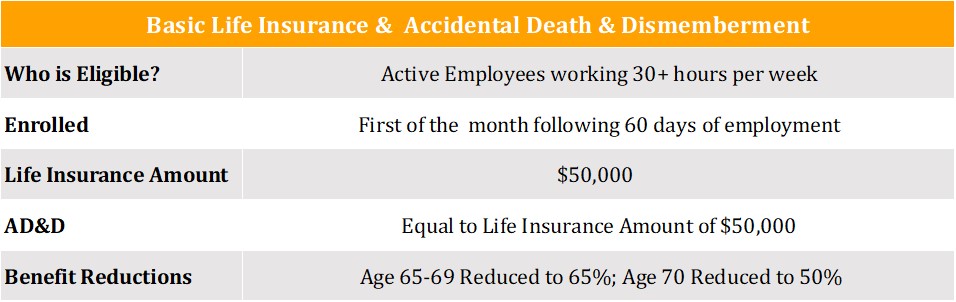

Summary of Group Basic Life and AD&D Benefits and Coverages

Insurance can play an important role in reducing financial stress when a family is faced with the pre-mature death or disability of a wage-earner.

To help employees during critical times of need, through Anthem, Littleton Food Co-op provides employer paid Life Insurance to all regular employees who work 30+ hours a week.

Basic Life insurance Benefits begin on the first of the month, following 60 days of employment within 90 days with a benefit amount of $50,000 for employees.

Below is a table outlining the benefit coverage:

Carrier Contact Information

Anthem: Basic Life and AD&D

Customer Service: 800-552-2137

Website: www.anthem.com

Contributions

Group Basic Life and AD&D is 100% paid for by Littleton Food Co-op.

Disability Insurance

Eligibility

All regular full-time employees who work 30 or more hours per week are eligible beginning on the first of the month, following 60 days of employment (within 90 days).

Employees are automatically enrolled through Anthem in STD & LTD as they become eligible.

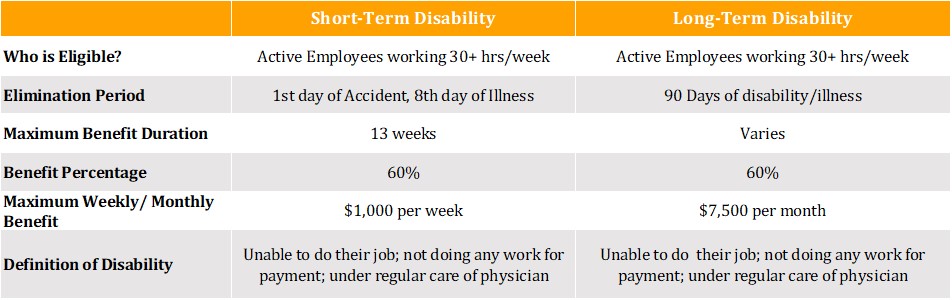

Summary of Benefits and Coverages

Most people don’t think about being disabled and unable to bring home their paycheck. Your financial obligations and living expenses don’t stop when you become disabled. Disability insurance can play an important role in reducing financial stress when facing the disability of a wage-earner.

To help you during critical times of need, through Anthem, Littleton Food Co-op provides employer paid Short and Long-Term Disability Insurance to all employees who work 30+ hours per week.

Short-Term Disability (STD)

- Eligibility is after 60 days of continuous employment

- Employees are automatically enrolled in Short-Term Disability Insurance

- Coverage is 60% of pre-disability weekly earnings to a maximum of $1,000 per week

- Benefits begin on the 1st day of a disabling injury and on the 8th day of a disabling illness

- The maximum benefit period is up to 26 weeks

Long-Term Disability (LTD)

- Eligibility is after 60 days of continuous employment

- Employees are automatically enrolled in Long-Term Disability Insurance

- Coverage is 60% of pre-disability weekly earnings to a maximum of $7,500 per month

- Benefits begin on the 90th day after the onset of your disability injury/illness or the date your STD ends.

Anthem: Disability Insurance

Customer Service: 800-552-2137

Website: www.anthem.com

Forms & Plan Documents

LifeWorks Employee Assistance Program (EAP)

EAP Details

Included with your Basic Life or Disability plan is Employee Assistance through Anthem and Resource Advisor.

The Employee Assistance Program through KGA is available to all employees.

The KGA Employee Assistance Program (EAP) is a confidential program available to support you and your adult household members at home and work. The services are offered through Littleton Food Coop and provided by KGA. The program is designed to provide solutions and support to people managing busy lives.

Services include counseling for a wide range of personal and work-related concerns. Counseling is available in several formats including in person, phone, video or message-based sessions to help resolve emotional and mental health issues.

Crisis- Immediate intervention for depression, anxiety, and substance abuse.

Financial- Consultations with licensed professionals for debt management, budgeting, and financial planning.

Other services- Provide assistance with legal, eldercare, nutrition, stress management, family and much more.

Confidential: All records are maintained by KGA EAP. Your conversations with an EAP counselor are confidential and can only be released with your written consent.

Free: There is no charge for using the EAP program. The employer has paid the fees. However, expenses may result from additional help recommended by the EAP counselor. Your health insurance plan may provide coverage for such treatment. The EAP counselor can assist you in determining if your plan will cover specific services.

![]()

KGA: Employee Assistance Program

Customer Service: 1-508-879-2093

Website: www.kgreer.com

Forms & Plan Documents

Additional Services provided by Anthem

Eligibility

All employees enrolled in the Basic Life Insurance plan provided by Littleton Food Co-op are eligible beginning on the first of the month, following 60 days of employment (within 90 days).

Summary of Benefits and Coverages

Resource Advisor

Included with your Basic Life or Disability plan is Employee Assistance through Anthem and Resource Advisor.

Services included with Resource Advisor are:

- Counseling

- Legal Assistance

- Financial Planning

- ID Theft recovery Services

- Online Tools

- Beneficiary Support & more

24/7 Phone Support: 1-888-209-7840

Online: www.ResourceAdvisor.Anthem.com

Program Name: AnthemResourceAdvisor

Special Offers Discounts

Save money with discounts on Family & Home, Health & Fitness, Medicine & Treatment, Vision, Hearing & Dental.

Log in to you account at www.anthem.com and select the discounts tab.

Travel Assistance

Anthem has teamed up with Generali Global Assistance, Inc. to offer Travel Assistance for members traveling more than 100 miles from home.

You’ll have access to:

- Emergency medical help, such as finding doctors, dentists and health care providers or getting and paying for medical evacuation. All services and transportation must be arranged in advance by GGA.

- Travel services, including getting and sending emergency messages, as well as emergency cash advances.

- Pre-departure information, such as immunization (shots) and passport needs, and travel alerts.

US and Canada: 1-866-295-4890

Other locations (call collect): 1-202-296-7482

Go to www.anthemlife.com for more details

Carrier Contact Information

Anthem: Additional Services

Customer Service: 1-888-209-7840

Website: www.ResourceAdvisor.Anthem.com

Forms & Plan Documents

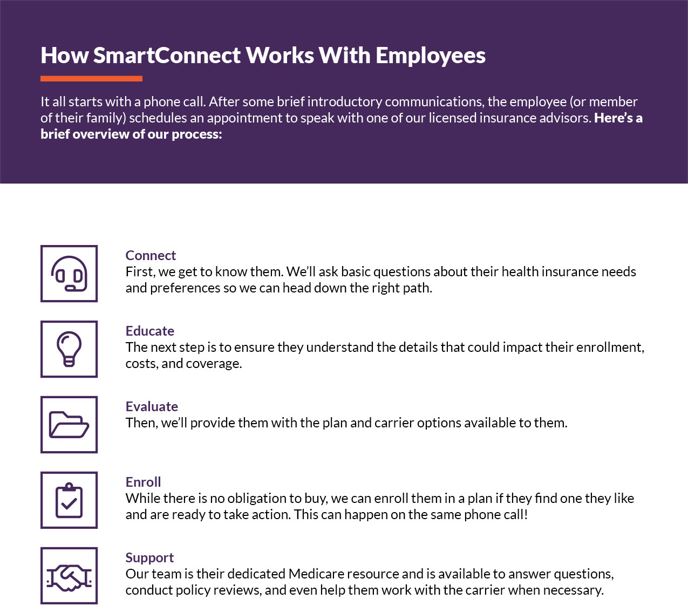

SmartConnect- Medicare Resource

Littleton Food Co-op has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Upcoming Webinar

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartconnectplan.com/littletoncoop

Additional Information

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

Phone: (844) GRADFIN

Website: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/